The information in this brief is intended only to provide educational information.

Versions of this brief were published in September 2021 and January 2023. The January 2023 update was to reflect revised projections for Boston’s population. This brief was updated again in October 2023 to more accurately represent the model period.

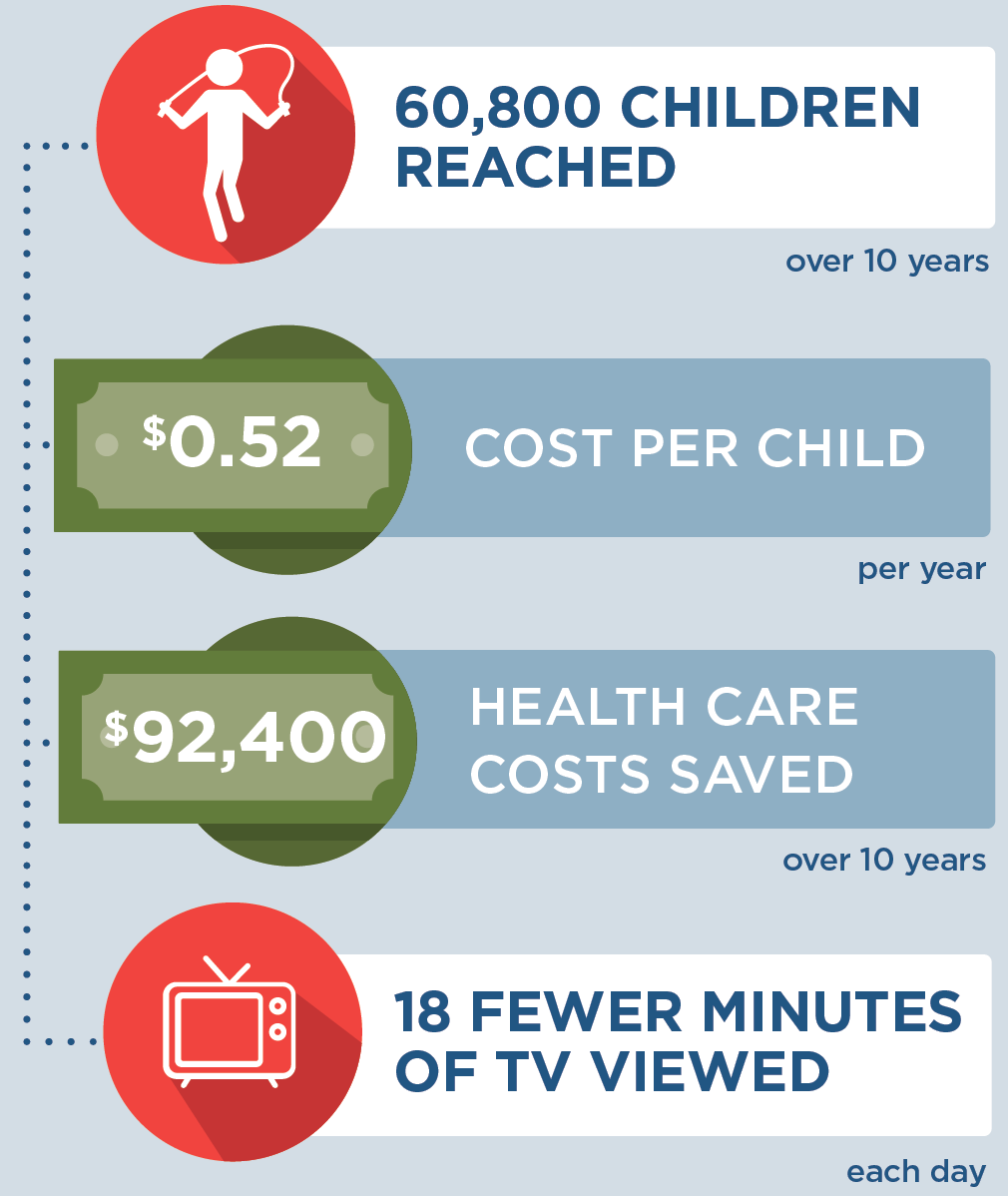

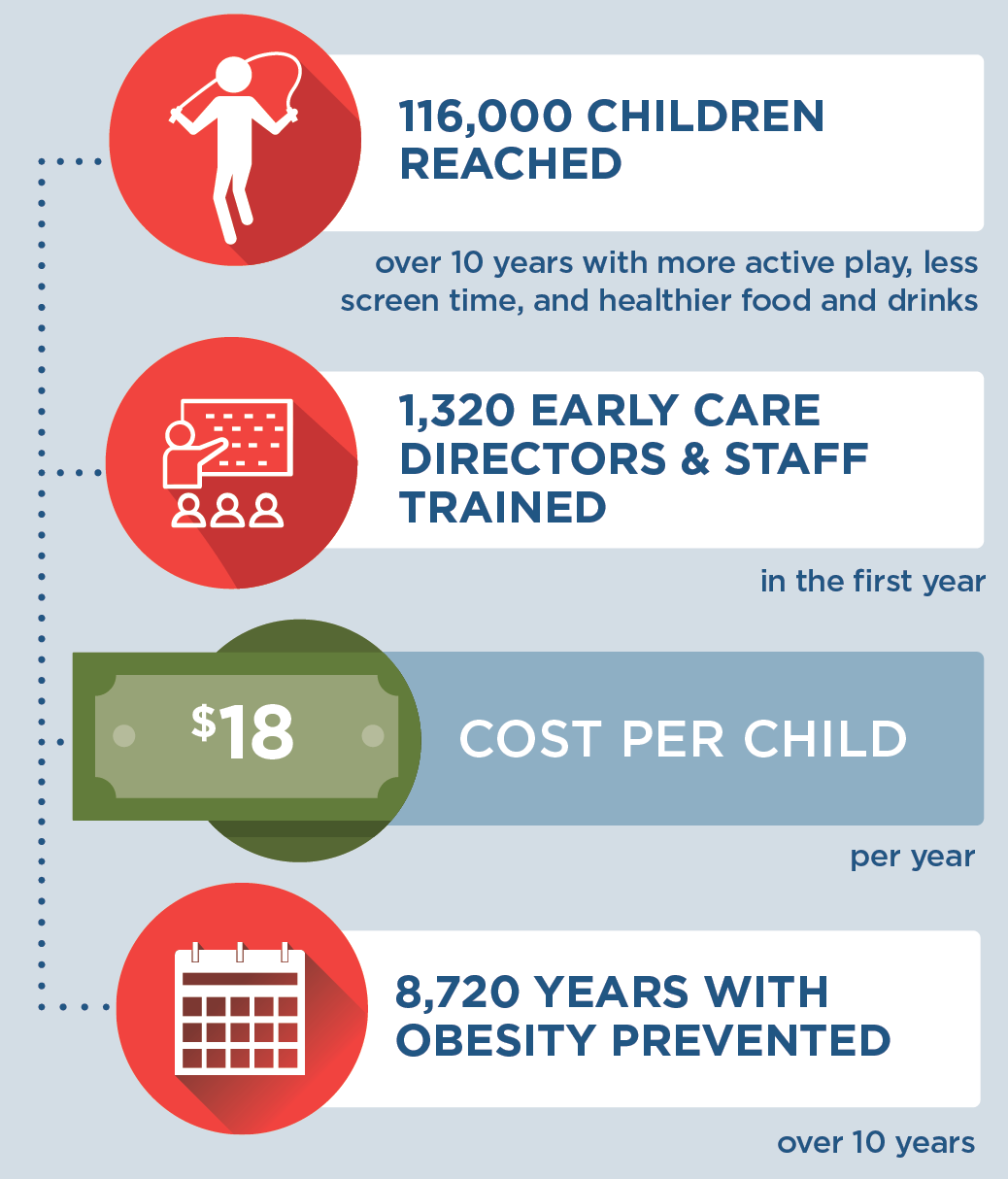

This brief summarizes a CHOICES Learning Collaborative Partnership model examining a strategy to reduce screen time in early child care settings in Boston. This strategy provides voluntary training to early child care educators and resources to families to limit noneducational television time at child care and home.

The Issue

Every child should have opportunities to grow up at a healthy weight. Too much screen time in early childhood is linked to overweight and obesity, as it reduces opportunities for children to be active and advertisement exposure can lead children to eat and drink more unhealthy foods.1 The American Academy of Pediatrics recommends limiting screen time to one hour of quality programming per day in child care and at home for children over 2 years old.2 Less than half of children ages 2-5 met this guideline.3

Limiting screen time at child care and home would support children’s healthy growth. In 2017, about three in 10 first graders in Boston had overweight or obesity.4 Reducing young children’s screen time will ensure more children grow up at a healthy weight and enter school ready to learn.

About the Strategy to Reduce Screen Time in Early Child Care Settings

This strategy could support Boston’s efforts to improve early child care quality through the Boston Healthy Child Care Initiative. It would include training opportunities for early child care educators, offering ongoing support and technical assistance, and providing parents with educational materials that may lead to reducing screen time in young children.5,6 Helping educators to implement practices shown to be effective in reducing television time can help the children in Boston’s early education and care settings engage in fewer minutes of screen time.

NOTE: The data that informed these estimates were collected after the program closures prompted by the COVID-19 pandemic. As programs reopen and demand continues to increase, this strategy could reach more children.

Comparing Costs and Outcomes

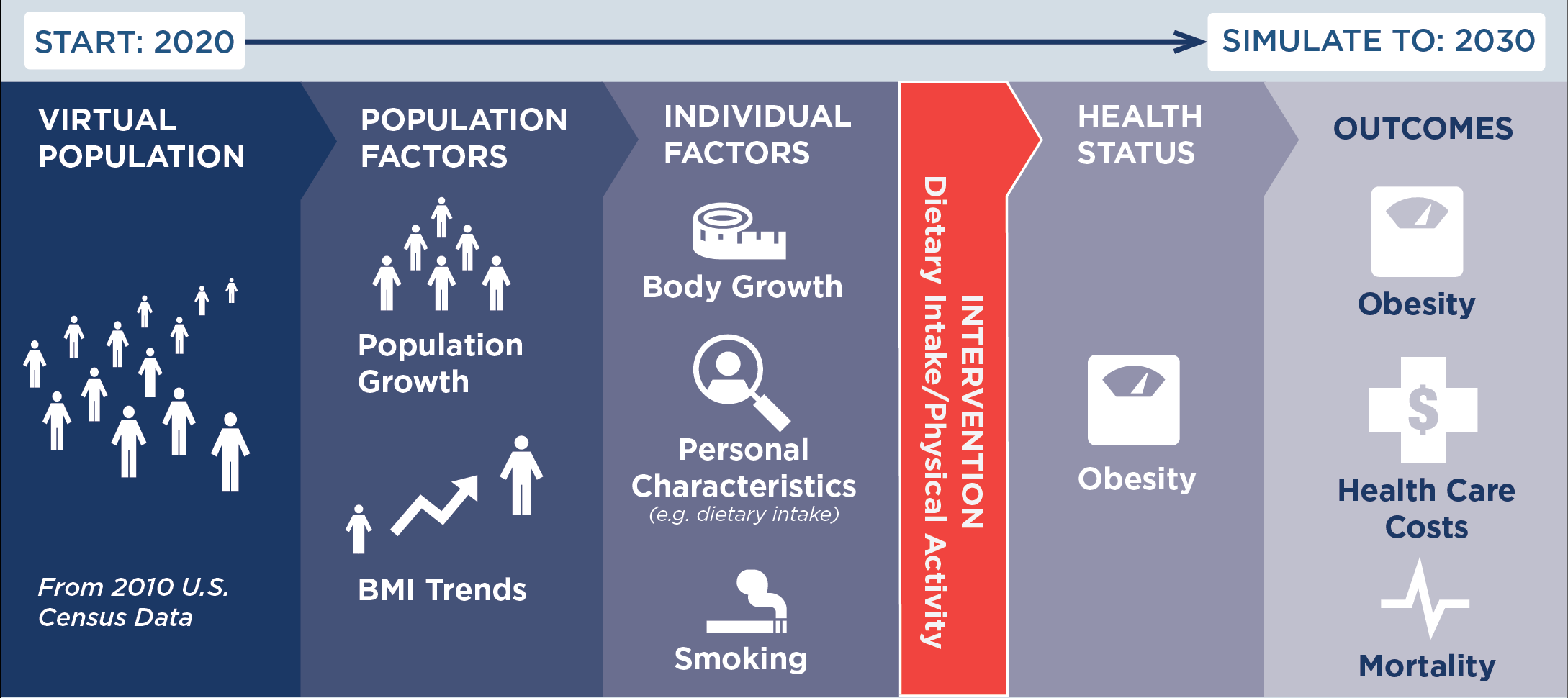

CHOICES cost-effectiveness analysis compared the costs and outcomes of implementing a strategy to reduce screen time in Boston early child care settings with the costs and outcomes associated with not implementing the strategy over 10 years (2020-2029).

|

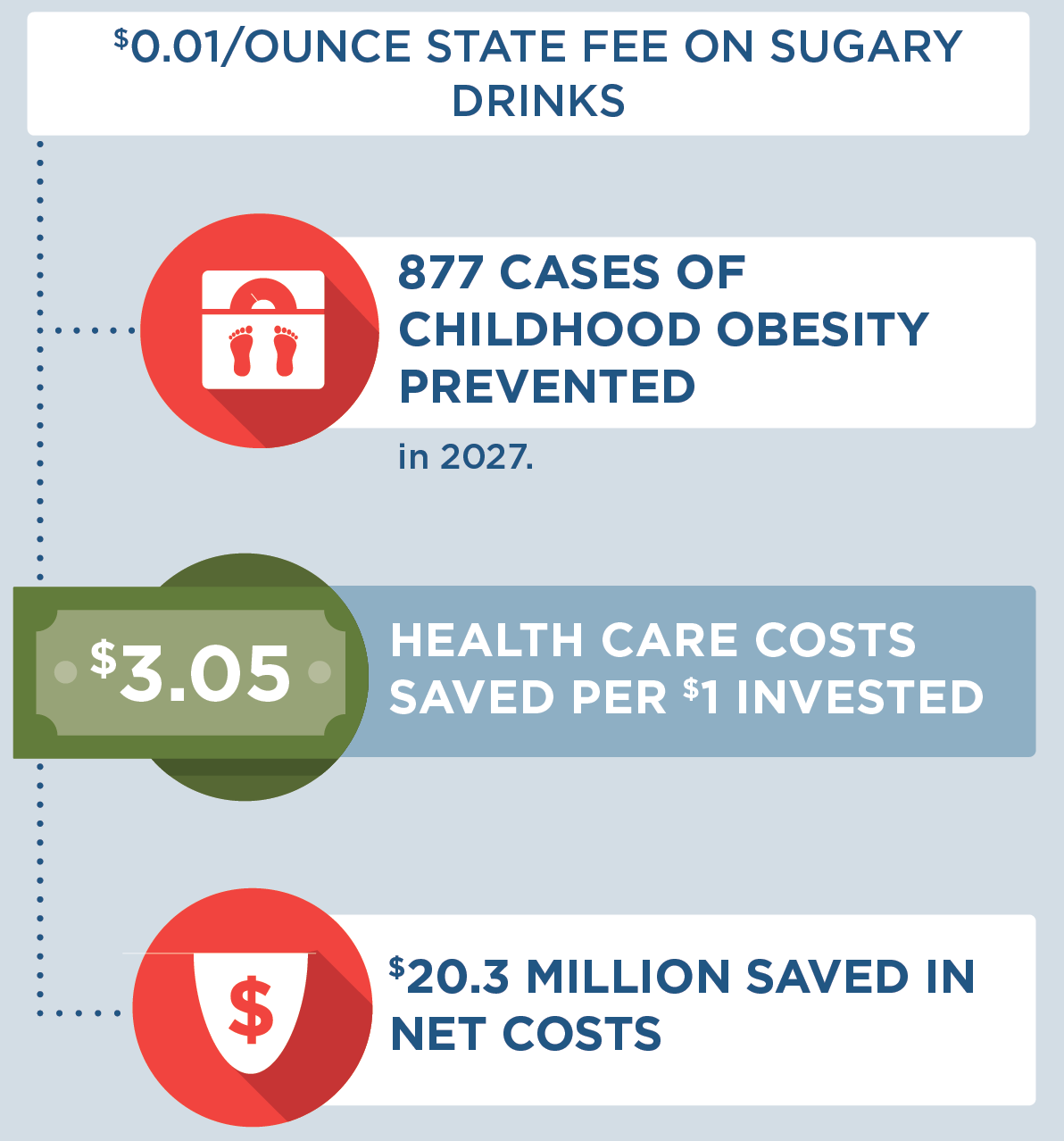

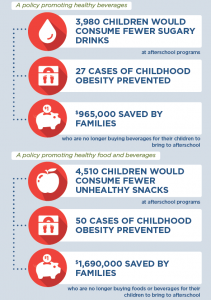

Implementing a strategy to reduce screen time in early child care settings is an investment in the future. By the end of 2029: |

Conclusions and Implications

If the strategy were implemented, we estimate that over 10 years, 18,200 children ages 3-5 would attend programs that support reducing screen time (based on the number of programs open during the COVID-19 pandemic). This strategy would prevent 125 cases of obesity in 2029 alone, saving $138,000 in obesity-related health care costs over 10 years. The average annual cost to implement this strategy would be $161 per program, or $16 per child.

Expanding training opportunities for early child care educators will also help support quality care. Ensuring access to quality care is essential for families and employers.7 In the initial training series, this strategy would provide additional skills training and professional development for 1,380 educators and more opportunities to reduce screen time in 570 (100%) child care programs serving 3-5 year olds.

Besides promoting a healthy weight, viewing less screen time benefits children in other ways. Too much screen use is associated with less sleep and can negatively impact social well-being.1 We estimate that, on average, each child attending a program implementing the strategy would view 33 fewer minutes of screen time per day. This allows more time for developmentally appropriate play activities, helping to form a strong foundation for overall well-being.

This strategy would train and provide technical assistance to early childhood educators on reducing screen time. As programs reopen post-pandemic and demand for child care continues to increase, the strategy could reach even more children. This strategy would enable early child care programs in Boston to support healthy growth because every child deserves a healthy start.

References

-

Li C, Cheng G, Sha T, Cheng W, Yan Y. The Relationships between Screen Use and Health Indicators among Infants, Toddlers, and Preschoolers: A Meta-Analysis and Systematic Review. International Journal of Environmental Research and Public Health. 2020;17(19):7324.

-

COUNCIL ON COMMUNICATIONS AND MEDIA. Media and Young Minds. Pediatrics. 2016;138(5):e20162591.

-

Healthy People 2030. Increase the proportion of children aged 2 to 5 who get no more than 1 hour of screen time a day – PA-13. Office of Disease Prevention and Health Promotion, Office of the Assistant Secretary for Health, Office of the Secretary, U.S. Department of Health and Human Services. Accessed July 20, 2021. https://health.gov/healthypeople/objectives-and-data/browse-objectives/physical-activity/increase-proportion-children-aged-2-5-years-who-get-no-more-1-hour-screen-time-day-pa-13/data

-

School Health Services, Dept of Public Health. Results from the Body Mass Index Screening in Massachusetts Public School Districts, 2017. School Health Services, Dept of Public Health; 2020. Accessed July 23, 2021. https://www.mass.gov/doc/the-status-of-childhood-weight-in-massachusetts-2017

-

Mendoza JA, Baranowski T, Jaramillo S, et al. Fit 5 Kids TV Reduction Program for Latino Preschoolers: A Cluster Randomized Controlled Trial. American Journal of Preventive Medicine. 2016;50(5):584-592.

-

Dennison BA, Russo TJ, Burdick PA, Jenkins PL. An intervention to reduce television viewing by preschool children. Archives of Pediatrics and Adolescent Medicine. 2004;158(2):170-176.

-

Campbell F, Patil P, McSwain K. Boston’s Child-Care Supply Crisis: What a Pandemic Reveals. November 2020. https://www.bostonopportunityagenda.org/-/media/boa/early-ed-census-2020-pt-1-202011.pdf

Suggested Citation:Bovenzi M, Carter S, Sabir M, Bolton AA, Barrett JL, Reiner JF, Cradock AL, Gortmaker SL. Boston, MA: Reducing Screen Time in Early Child Care Settings {Issue Brief}. Boston Public Health Commission and the CHOICES Learning Collaborative Partnership at the Harvard T.H. Chan School of Public Health, Boston, MA; October 2023. For more information, please visit www.choicesproject.org Versions of this brief were published in September 2021 and January 2023. The January 2023 update was to reflect revised projections for Boston’s population. This brief was updated again in October 2023 to more accurately represent the model period. The design for this brief and its graphics were developed by Molly Garrone, MA and partners at Burness. |

This issue brief was developed at the Harvard T.H. Chan School of Public Health in collaboration with the Boston Public Health Commission through participation in the Childhood Obesity Intervention Cost-Effectiveness Study (CHOICES) Learning Collaborative Partnership. This brief is intended for educational use only. This work is supported by The JPB Foundation and the Centers for Disease Control and Prevention (U48DP006376). The findings and conclusions are those of the author(s) and do not necessarily represent the official position of the Centers for Disease Control and Prevention or other funders.