The information in this brief is intended to provide educational information on the cost-effectiveness of sugary drink excise taxes.

Executive Summary

Continually rising rates of obesity represent one of the greatest public health threats facing the United States. Obesity has been linked to excess consumption of sugary drinks. Federal, state, and local governments have considered implementing excise taxes on sugary drinks to reduce consumption, reduce obesity and provide a new source of government revenue.1-4

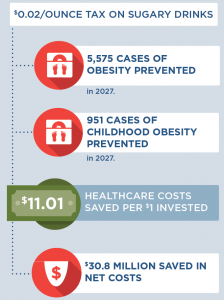

We modeled implementation of a city excise tax, a tax on sugary drinks only, at a tax rate of $0.02/ounce.

The tax model was projected to be cost-saving and resulted in lower levels of sugary drink consumption, thousands of cases of obesity prevented, and hundreds of millions of dollars in health care cost savings. Health care cost savings per dollar invested was $11 in the model.

Background

Although sugary drink consumption has declined in recent years, adolescents and young adults in the United States consume more sugar than the Dietary Guidelines for Americans 2015-2020 recommends, with persistent racial/ethnic disparities.5-9 According to recent estimates, 26% of adults and 21% of youth in Denver drink at least one soda or other sugary drink per day.10,11 Public health researchers have suggested that excess intake of sugary drinks may be one of the single largest drivers of the obesity epidemic in the U.S.12 An estimated 57% of adults and nearly 30% of children ages 2-17 in Denver have overweight or obesity.10,13

Targeted marketing contributes to differences in consumption by race/ethnicity group. Black youth are twice as likely to see TV ads for sugary drinks as White non-Hispanic youth.14 Hispanic and Black youth are a target growth market for sugary drinks. On the other hand, Black and Hispanic youth are less likely to be the audience for company marketing of more healthy beverage alternatives, like water.15 Consumption of sugary drinks increases the risk of chronic diseases through changes in body mass index (BMI), insulin regulation, and other metabolic processes.16-18 Randomized intervention trials and longitudinal studies have linked increases in sugary drink consumption to excess weight gain, diabetes, cardiovascular disease, and other health risks.16,17 There are persistent racial and ethnic disparities across both sugary drink consumption levels and rates of obesity and chronic disease.5-8 In light of this evidence, the Dietary Guidelines for Americans 2015-20209 recommends that individuals limit sugary drink intake in order to manage body weight and reduce risk of chronic disease.

Taxation has emerged as one recommended strategy to reduce consumption of sugary drinks.12,19 This strategy has been studied by public health experts, who have drawn on the success of tobacco taxation and decades of economic research to model the estimated financial and health impact of an sugary drink excise tax.20-23 Sugary drinks include all drinks with added caloric sweeteners. Proposed and enacted sugary drink excise taxes typically do not apply to 100% juice or milk products. This report aims to model the projected effect of sugary drink excise taxes on health and disease outcomes over the next decade.

Modeling Framework: How excise taxes can lead to better health

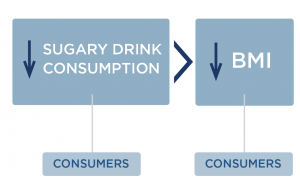

Increased local excise tax is linked to change in BMI through change in sugary drink price and consumption

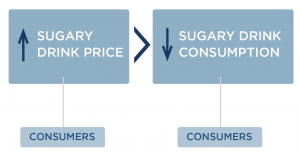

How does increasing the price of sugary drinks change individual sugary drink consumption?

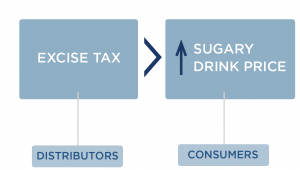

Since the cost of a sugary drink excise tax is incorporated directly into the beverage’s sticker price, an excise tax will likely influence consumer purchasing decisions more than a comparable sales tax that is added onto the item at the register. We assume 100% pass-through of the tax over 10 years and assume the tax rate would be adjusted annually for inflation. Our pass-through rate estimate is supported by empirical studies of excise taxes in Mexico and France that demonstrate near-complete pass through rates to consumers.24 Short term studies for the local tax in Berkeley indicate imperfect, or less than 100%, pass-through.3,25,26 The expected change in sugary drink price was estimated using an average of $0.06/ounce based on national sugary drink prices.27 The price per ounce in this study was based on a weighted average of sugary drink consumption across stores, restaurants and other sources according to the estimates from the National Health and Nutrition Examination Survey (NHANES) 2009-2010. The price per ounce of sugary drinks purchased in stores was calculated using weighted averages of two-liter bottles, 12-can cases, and single-serve containers based on 2010 Nielsen Homescan data.27 For example, a $0.02/ounce tax would raise the price of a 12-ounce can of soda from $0.72 to $0.96/can post-tax.

Since the cost of a sugary drink excise tax is incorporated directly into the beverage’s sticker price, an excise tax will likely influence consumer purchasing decisions more than a comparable sales tax that is added onto the item at the register. We assume 100% pass-through of the tax over 10 years and assume the tax rate would be adjusted annually for inflation. Our pass-through rate estimate is supported by empirical studies of excise taxes in Mexico and France that demonstrate near-complete pass through rates to consumers.24 Short term studies for the local tax in Berkeley indicate imperfect, or less than 100%, pass-through.3,25,26 The expected change in sugary drink price was estimated using an average of $0.06/ounce based on national sugary drink prices.27 The price per ounce in this study was based on a weighted average of sugary drink consumption across stores, restaurants and other sources according to the estimates from the National Health and Nutrition Examination Survey (NHANES) 2009-2010. The price per ounce of sugary drinks purchased in stores was calculated using weighted averages of two-liter bottles, 12-can cases, and single-serve containers based on 2010 Nielsen Homescan data.27 For example, a $0.02/ounce tax would raise the price of a 12-ounce can of soda from $0.72 to $0.96/can post-tax.

How does an excise tax on distributors affect the price paid by consumers?

How does an excise tax on distributors affect the price paid by consumers?

We used local age and race/ethnicity specific estimates of adult sugary drink consumption from the Colorado Behavioral Risk Factor Surveillance System10 and youth sugary drink consumption from the Healthy Kids Colorado Survey28 to adjust national estimates of sugary drink consumption from NHANES 2011-2014 to estimate current sugary drink consumption levels in Denver. The mean own-price elasticity of demand for sugar-sweetened soft drinks (not including diet) is -1.21.29 Recent research on the Berkeley tax indicating a 21% reduction in sugary drink intake among low income populations supports this estimate.25

What are the individual health effects of decreasing sugary drink consumption?

Research has shown that decreasing sugary drink consumption can have positive effects on health in adults and youth. We conducted evidence reviews for the impact of a change in sugary drink intake on BMI, accounting for dietary compensation.23 Four large, multi-year longitudinal studies in adults17,30-32 were identified. The relationship was modeled using a uniform distribution based on the range of estimated effects on BMI due to reducing sugary drink intake; a one-serving reduction was associated with a BMI decrease of 0.57 in adults. Among youth, a double-blind randomized controlled trial conducted over 18 months found that an additional 8 ounce serving of sugary drinks led to a 2.2 lbs greater weight gain.33

Reach

The intervention applies to all youth and adults in Denver. However, the model only looks at the effects on those 2 years of age and older.*

*BMI z-scores were used in our analyses, which are not defined for children under 2 years of age.

Cost

We assume the tax will incur start up and ongoing labor costs for tax administrators in the Denver Department of Finance. To implement the intervention, the Denver Department of Finance would need to process tax statements and conduct audits. Businesses would also need to prepare tax statements and participate in audits, which would require labor from private tax accountants. Cost information was drawn from localities with planned or implemented excise taxes on soft drinks.22,23 The cost and benefit estimates do not include expected tax revenue.

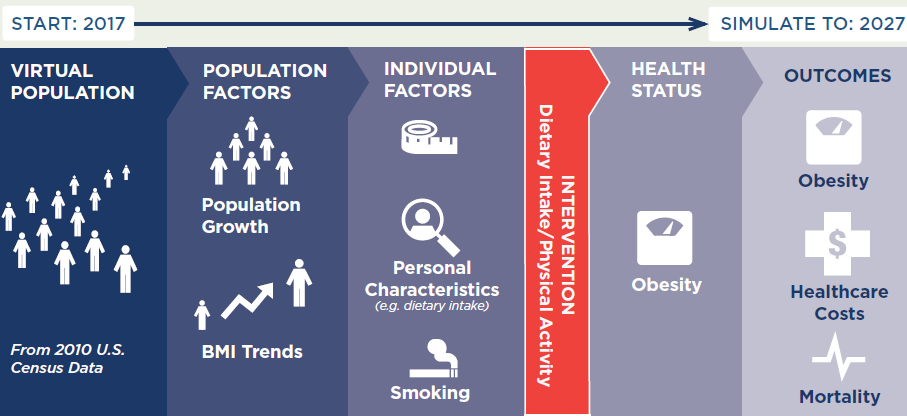

CHOICES Microsimulation Model

The CHOICES microsimulation model for Denver was used to calculate the costs and effectiveness over 10 years (2017–27). Cases of obesity prevented were calculated at the end of the model period in 2027. The model was based on prior CHOICES work23,34, and created a virtual population of Denver residents using data from: U.S. Census, American Community Survey, Behavioral Risk Factor Surveillance System10,16, NHANES, National Survey of Children’s Health35, the Medical Expenditure Panel Survey, multiple national longitudinal studies, and obesity prevalence data provided by Denver Public Health and Denver Health and Hospital Authority. Using peer-reviewed methodology, we forecasted what would happen to this virtual population with and without a sugary drink tax to model changes in disease and mortality rates, and health care costs due to the tax.

Results: $0.02/ounce City Excise Tax on Sugary Drinks

Overall, the model shows that a sugary drink excise tax is cost-saving. Compared to the simulated natural history without a tax, the tax is projected to result in lower levels of sugary drink consumption, fewer cases of obesity, fewer deaths, and health care savings greater than $33 million dollars over the 10-year period under consideration.

The estimated reduction in obesity attributable to the tax leads to lower projected health care costs, offsetting tax implementation costs and resulting in net cost savings. The difference between total health care costs with no intervention and lower health care costs with an intervention represent health care costs saved; these savings can be compared to the cost of implementing the tax to arrive at the metric of health care costs saved per $1 invested.

| Outcome | $0.02/ounce excise tax Mean (95% uncertainty interval) |

| 10 Year Reach* | 963,000 (960,000; 965,000) |

| First Year Reach* | 733,000 (732,000; 734,000) |

| Decrease in 12-oz Serving of Sugary Drinks per Person in First Year* | 75.2 (43.9; 158) |

| Mean Reduction in BMI Units per Person* | -0.146 (-0.400; -0.0451) |

| 10 Year Intervention Implementation Cost per Person | $3.20 ($3.19; $3.20) |

| Total Intervention Implementation Cost Over 10 Years | $3,080,000 ($3,080,000; $3,080,000) |

| Annual Intervention Implementation Cost | $308,000 ($308,000; $308,000) |

| Health Care Costs Saved Over 10 Years | $33,900,000 ($10,400,000; $90,800,000) |

| Net Costs Difference Over 10 Years | -$30,800,000 (-$87,800,000; -$7,310,000) |

| Quality Adjusted Life Years (QALYs) Gained Over 10 Years | 1,320 (406; 3,560) |

| Years of Life Gained Over 10 Years | 250 (66; 665) |

| Deaths Prevented Over 10 Years* | 78 (21; 204) |

| Years with Obesity Prevented Over 10 Years | 36,600 (11,500; 97,500) |

| Health Care Costs Saved per $1 Invested Over 10 Years | $11.01 ($3.38; $29.50) |

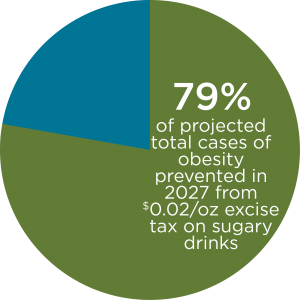

| Cases of Obesity Prevented in 2027* | 5,575 (1,760; 14,800) |

| Cases of Childhood Obesity Prevented in 2027* | 951 (316; 2,470) |

| Cost per Year with Obesity Prevented Over 10 Years | Cost-saving |

| Cost per QALY Gained Over 10 Years | Cost-saving |

| Cost per YL Gained Over 10 Years | Cost-saving |

| Cost per Death Averted Over 10 Years | Cost-saving |

Uncertainty intervals are estimated by running the model 1,000 times, taking into account both uncertainty from data sources and virtual population projections, and calculating a central range in which 95 percent of the model results fell.

All metrics reported for the population over a 10-year period and discounted at 3% per year, unless otherwise noted.

*Not discounted.

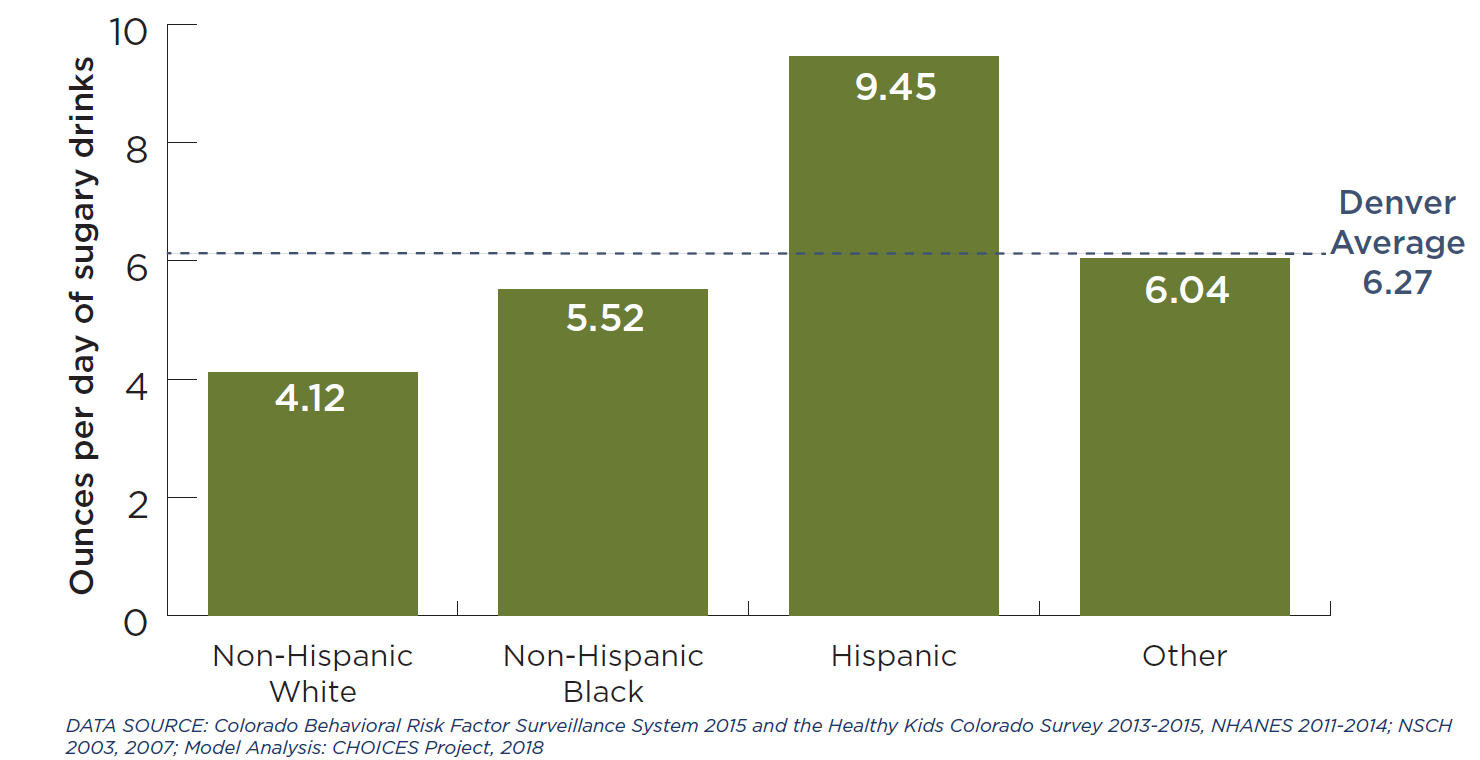

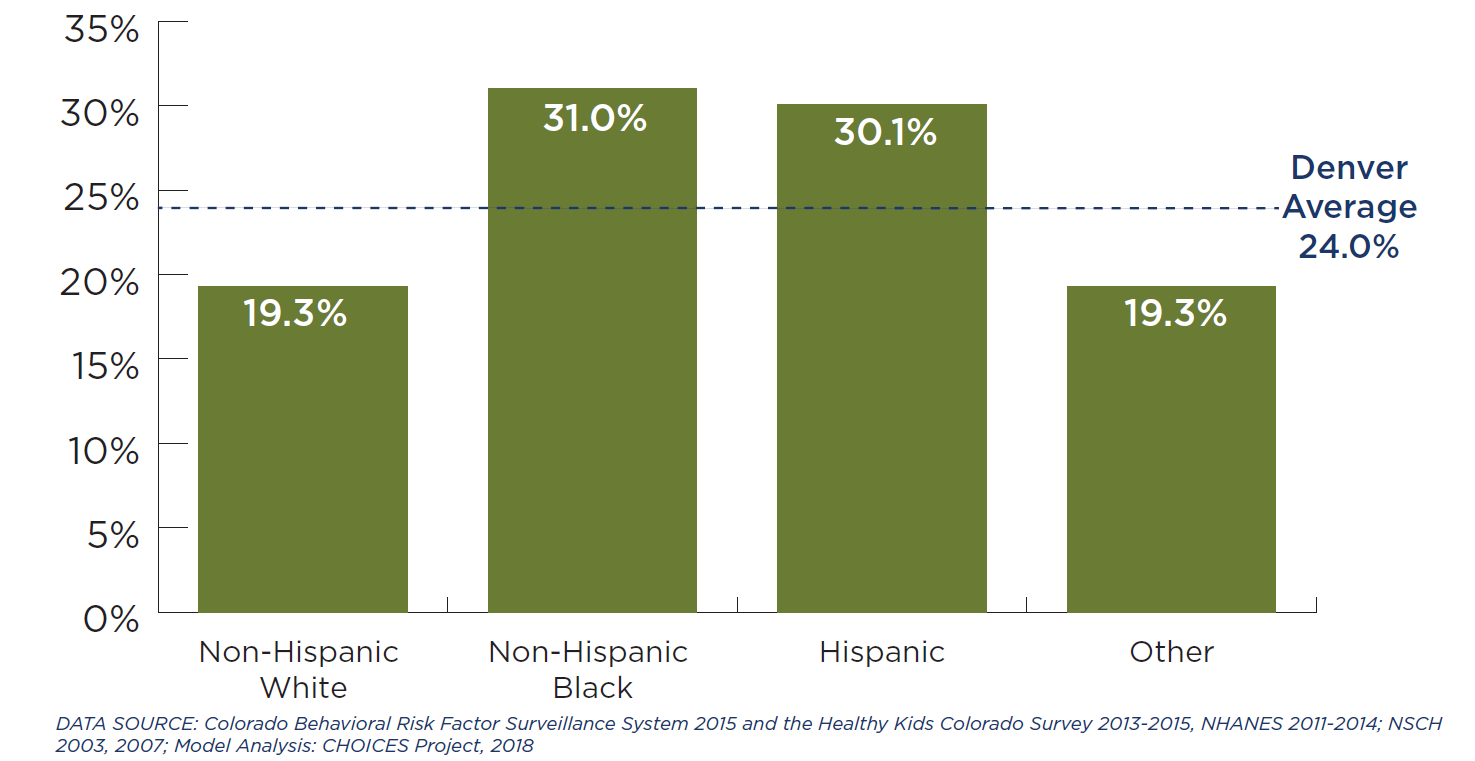

There are differences in sugary drink consumption and obesity prevalence by race/ethnicity in Denver. The CHOICES model used local data to build a virtual Denver population. Without any intervention:

Sugary drink consumption is highest in the Hispanic population

Obesity prevalence is highest in the Non-Hispanic Black and Hispanic populations

Results: $0.02/ounce City Excise Tax on Sugary Drinks by Race/Ethnicity Groups

| Outcome | Non-Hispanic White Mean (95% uncertainty interval) |

Non-Hispanic Black Mean (95% uncertainty interval) |

Hispanic Mean (95% uncertainty interval) |

Other Mean (95% uncertainty interval) |

| Decrease in 12-oz Serving of Sugary Drinks per Person in First Year* | 49.5 (28.8; 103) |

66.3 (38.7; 140) |

113 (66.2; 238) |

72.5 (42.2; 152) |

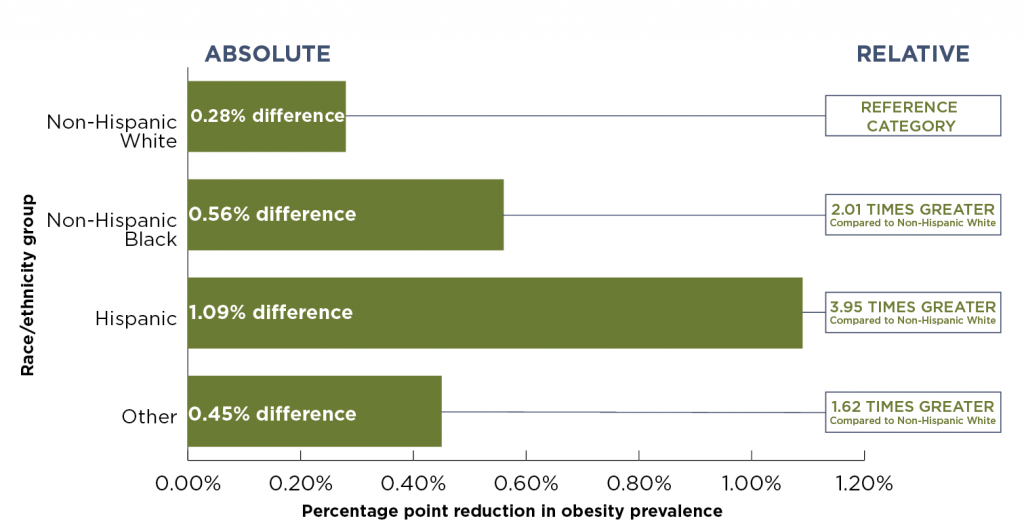

| Reduction in Obesity Prevalence | 0.28% (0.09%; 0.75%) |

0.56% (0.17%; 1.53%) |

1.09% (0.35%; 2.93%) |

0.45% (0.13%; 1.19%) |

| QALYS Gained Over 10 Years | 352 (106; 964) |

137 (41; 369) |

762 (231; 2,040) |

66 (17; 185) |

| Years of Life Gained Over 10 Years | 90 (19; 263) |

34 (5; 97) |

108 (22; 294) |

18 (0; 53) |

| Years with Obesity Prevented Over 10 Years | 8,030 (2,500; 21,700) |

3,220 (993; 8,860) |

23,700 (7,490; 63,800) |

1,690 (511; 4,540) |

| Cases of Obesity Prevented in 2027* | 1,200 (376; 3,240) |

479 (145; 1,320) |

3,640 (1,160; 9,760) |

256 (76; 681) |

| Cases of Childhood Obesity Prevented in 2027* | 146 (48; 397) |

92 (30; 244) |

663 (219; 1,760) |

50 (15; 138) |

Uncertainty intervals are estimated by running the model 1,000 times, taking into account both uncertainty from data sources and virtual population projections, and calculating a central range in which 95 percent of the model results fell.

All metrics reported for the population over a 10-year period and discounted at 3% per year, unless otherwise noted.

*Not discounted.

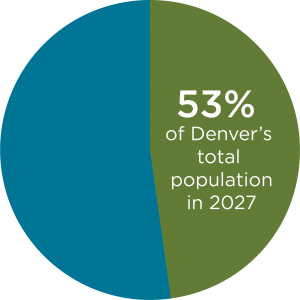

Communities of color make up: |

|

|

|

| Race/Ethnicity Group | % of Total Population | Total Number of Cases of Obesity Prevented in 2027 | % of Total Number of Cases of Obesity Prevented in 2027 |

| Non-Hispanic White | 47% | 1,200 | 21% |

| Hispanic | 37% | 3,640 | 65% |

| Non-Hispanic Black | 10% | 479 | 9% |

| Other | 6% | 256 | 5% |

| Total | 100% | 5,575 | 100% |

A $0.02/ounce excise tax on sugary drinks is projected to have a greater health impact on Non-Hispanic Black and Hispanic communities in Denver

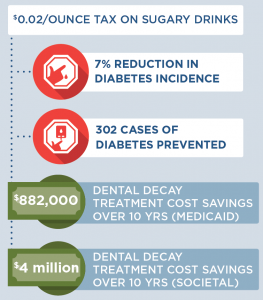

Impact on Diabetes

We estimated the impact of the tax-induced reduction in sugary drink intake on diabetes incidence for adults ages 18-79 years using a published meta-analysis of the relative risk of developing diabetes due to a one-serving change in sugary drink consumption36 as well as local estimates of diabetes. On average, each 8.5 ounce serving of sugary drinks per day increases the risk of diabetes by 18%.36

In Denver, we estimated that the proposed sugary drink excise tax would lead to a 7% reduction in diabetes incidence in the sugary drink tax model. Impact on diabetes incidence was calculated over a one-year period once the tax reaches its full effect. Impact on diabetes was calculated based on summary results from the model, not directly via microsimulation.

Impact on Tooth Decay

We estimated the impact of a sugary drink excise tax on tooth decay cost using a longitudinal analysis of the relationship between intake of sugars and tooth decay in adults. On average, for every 10 grams higher intake of sugar per day, there is an increase in decayed, missing and filled teeth (DMFT) of approximately 0.10 over 10 years.37 As described above, we assume that the excise tax will result in a reduction in sugary drink intake. There are many studies showing a similar relationship between higher intake of sugars and tooth decay in children and youth38 and thus we assume the same relationship as found in adults.

We used 2018 Health First Colorado Dental Fee Schedule39 data to estimate a Medicaid cost of treating DMFT as: $232.28 for a permanent crown and $83.59 for a filling. These codes reflect treatment for one surface and do not reflect higher reimbursement rates for multi-surface treatment, temporary crowns, or potential flat tax schedules. Based on analysis of data on tooth decay, fillings and crowns for the U.S. population from NHANES 1988-1994 (the last year crowns and fillings were separately reported)40, we estimate that 78.9% of tooth decay in children and 43.5% of tooth decay in adults is treated. Using this same data set, we estimate that 97.5% of treatment for children is fillings and 82.5% of treatment for adults is fillings.

To estimate Medicaid-specific dental caries cost savings, we used local estimates of the numbers of people enrolled in Medicaid and the proportion receiving Medicaid dental services. Because of limited Medicaid dental coverage for adults in Denver, only children are included in the Medicaid-specific calculations. In Denver, we estimated that a $0.02/ounce tax would lead to a total DMFT savings of $882,000 in Medicaid savings over a period of 10 years. The Medicaid reimbursement tax estimates may underestimate the total cost savings of tooth decay treatment projected here as dental providers may charge higher amounts to patients.

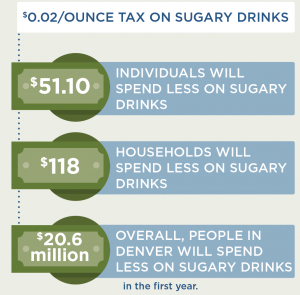

Considerations for Health Equity

Concerns have been raised regarding the impact of the tax on households with low income households. For many goods, including cigarettes, low-income households are more price-sensitive than high-income peers. If this is also true for low-income sugary drink consumers, these households would spend less on sugary drinks after the tax goes into effect, which would free up disposable income for other consumer purchases.41 Using sales data from the Rudd Center Sugary Beverage calculator42, we project that individuals and households in Denver will spend less money on sugary drinks after the tax.

In addition, low-income consumers on average consume more sugary drinks than higher income consumers. We therefore project that greater health benefits from this policy will accrue to these consumers; the same is true for a number of racial and ethnic groups (see pages 9-10). Using data from NHANES and Denver on sugary drink consumption in the CHOICES model, the average daily consumption of sugary drinks by people in Denver varies by racial and ethnic group (see page 8). Under the proposed tax, Hispanic Denver residents are projected to experience a fourfold reduction in obesity prevalence compared to White non-Hispanic Denver residents. Similarly, the reduction in obesity prevalence among Black non-Hispanic Denver is projected to be almost twice as high as the reduction among White non-Hispanic Denver residents. On that basis, the proposed tax should tend to decrease disparities in obesity outcomes.

Implementation Considerations

Revenue raised from a sugary drink tax can be reinvested in low-income communities. For instance, in Berkeley, CA, sugary drink tax revenue has been allocated for spending on school and community programs to promote healthy eating, diabetes and obesity prevention; many serve low-income or minority populations.43,44 Public support for such taxes generally increases with earmarking for preventive health activities.44

There is opposition from the food and beverage industry, which spends billions of dollars promoting their products.45 Relatively small beverage excise taxes are currently applied across many states. The proposed tax is likely to be sustainable if implemented based on the successful history of tobacco excise taxes. There is potential for a shift in social norms of sugary drink consumption based on evidence from tobacco control tax and regulatory efforts.46 This shift in norms can be facilitated by taxing sugary beverages, which increases the attractiveness of non-caloric beverages options and discourages consumers from selecting any soft drink options when making beverage decisions.

Conclusion

We project that a tax policy in Denver will prevent thousands of cases of childhood and adult obesity, prevent new cases of diabetes, increase healthy life years and save more in future health care costs than it costs to implement. Revenue from the tax can be used for education and health promotion efforts. Implementing the tax could also serve as a powerful social signal to reduce sugar consumption.

Citation

Moreland J, Kraus (McCormick) E, Long MW, Ward ZJ, Giles CM, Barrett JL, Cradock AL, Resch SC, Greatsinger A, Tao H, Flax CN, and Gortmaker SL. Denver: Sugary Drink Excise Tax. The CHOICES Learning Collaborative Partnership at the Harvard T.H. Chan School of Public Health, Boston, MA; December 2018.

The design for this brief and its graphics were developed by Molly Garrone, MA and partners at Burness.

Funding

This work is supported by The JPB Foundation. This report is intended for educational use only. Results are those of the authors and not the funders.

For further information, contact choicesproject@hsph.harvard.edu

References

- American Public Health Association Taxes on Sugar-Sweetened Beverages. 2012.

- Hakim D, Confessore N. Paterson seeks huge cuts and $1 billion in taxes and fees. New York Times. January 19, 2010.

- Falbe J, Rojas N, Grummon AH, Madsen KA. Higher Retail Prices of Sugar-Sweetened Beverages 3 Months After Implementation of an Excise Tax in Berkeley, California. American Journal of Public Health. 2015;105(11):2194-2201.

- Leonhardt D. The battle over taxing soda. The New York Times. May 19, 2010.

- Wang YC, Bleich SN, Gortmaker SL. Increasing caloric contribution from sugar-sweetened beverages and 100% fruit juices among US children and adolescents, 1988-2004. Pediatrics. 2008;121(6):E1604-E1614.

- Bleich SN, Wang YC, Wang Y, Gortmaker SL. Increasing consumption of sugar-sweetened beverages among US adults: 1988-1994 to 1999-2004. Am J Clin Nutr. 2009;89(1):372-381.

- Kit BK, Fakhouri THI, Park S, Nielsen SJ, Ogden CL. Trends in sugar-sweetened beverage consumption among youth and adults in the United States: 1999-2010. Am J Clin Nutr. 2013;98(1):180-188.

- Bleich SN, Vercammen KA, Koma JW, Li ZH. Trends in Beverage Consumption Among Children and Adults, 2003-2014. Obesity. 2018;26(2):432-441.

- U.S. Department of Health and Human Services, U.S. Department of Agriculture. 2015 – 2020 Dietary Guidelines for Americans. December 2015 2015.

- Colorado Department of Public Health and Enviornment. Colorado Behavioral Risk Factor Surviellence System 2015.

- Colorado Department of Public Health and Enviornment. Colorado Health Indicators: Health Behaviors and Conditions.

- Brownell KD, Frieden TR. Ounces of Prevention – The Public Policy Case for Taxes on Sugared Beverages. N Engl J Med. 2009;360(18):1805-1808.

- Denver Childhood Obesity Monitoring Report 2012-2016, Denver Public Health, http://www.denverpublichealth.org/Portals/32/Public-Health-and-Wellness/Public-Health/Health-Information/Docs/DPH-Health-Information-and-Reports-2016-Denver-Childhood-Obesity-Report_Final_20170803.pdf?ver=2017-08-03-101748-433

- Harris J, Shehan C, Gross R, et al. Food advertisting targeted to Hispanic and Black youth: Contributing to health disparities. August 2015.

- Yancey AK, Cole BL, Brown R, et al. A cross-sectional prevalence study of ethnically targeted and general audience outdoor obesity-related advertising. Milbank Q. 2009;87(1):155-184.

- Malik VS, Pan A, Willett WC, Hu FB. Sugar-sweetened beverages and weight gain in children and adults: a systematic review and meta-analysis. The American Journal of Clinical Nutrition. 2013;98(4):1084-1102.

- Chen L, Caballero B, Mitchell DC, et al. Reducing Consumption of Sugar-Sweetened Beverages Is Associated with Reduced Blood Pressure: A Prospective Study among U.S. Adults. Circulation. 2010;121(22):2398-2406.

- Wang Y. The potential impact of sugar-sweetened beverage taxes in New York State. A report to the New York State Health Commissioner. New York: Columbia Mailman School of Public Health. 2010.

- IOM (Institute of Medicine), National Research Council. Local Government Actions to Prevent Childhood Obesity. Washington, DC: The National Academies Press; 2009.

- Chaloupka F, Powell L, Chriqui J. Sugar-sweetened beverage taxes and public health: A Research Brief. Minneapolis, MN2009.

- Brownell KD, Farley T, Willett WC, et al. The Public Health and Economic Benefits of Taxing Sugar-Sweetened Beverages. N Engl J Med. 2009;361(16):1599-1605.

- Long M, Gortmaker S, Ward Z, et al. Cost Effectiveness of a Sugar-Sweetened Beverage Excise Tax in the U.S. Am J Prev Med. 2015;49(1):112-123.

- Gortmaker SL, Wang YC, Long MW, et al. Three Interventions That Reduce Childhood Obesity Are Projected To Save More Than They Cost To Implement. Health Aff. 2015;34(11):1932-1939.

- Colchero MA, Salgado JC, Unar-Munguia M, Molina M, Ng SW, Rivera-Dommarco JA. Changes in Prices After an Excise Tax to Sweetened Sugar Beverages Was Implemented in Mexico: Evidence from Urban Areas. PLoS One. 2015;10(12):11.

- Falbe J, Thompson HR, Becker CM, Rojas N, McCulloch CE, Madsen KA. Impact of the Berkeley Excise Tax on Sugar-Sweetened Beverage Consumption. American Journal of Public Health. 2016;106(10):1865-1871.

- Ng S, Silver L, Ryan-Ibarra S, et al. Berkeley Evaluation of Soda Tax (BEST) Study Preliminary Findings. Presentation at the annual meeting of the American Public Health Association. Paper presented at: Presentation at the annual meeting of the American Public Health Association; November, 2015; Chicago, IL.

- Powell L, Isgor z, Rimkus L, Chaloupka F. Sugar-sweetened beverage prices: Estimates from a national sample of food outlets. Chicago, IL: Bridging the Gap Program, Health Policy Center, Institute for Health Research and Policy, University of Illinois at Chicago;2014.

- Colorado Department of Public Health and Enviornment. Health Kids Colorado Survey. 2013 – 2015.

- Powell LM, Chriqui JF, Khan T, Wada R, Chaloupka FJ. Assessing the Potential Effectiveness of Food and Beverage Taxes and Subsidies for Improving Public Health: A Systematic Review of Prices, Demand and Body Weight Outcomes. Obesity reviews : an official journal of the International Association for the Study of Obesity. 2013;14(2):110-128.

- Mozaffarian D, Hao T, Rimm EB, Willett WC, Hu FB. Changes in Diet and Lifestyle and Long-Term Weight Gain in Women and Men. The New England journal of medicine. 2011;364(25):2392-2404.

- Palmer JR, Boggs DA, Krishnan S, Hu FB, Singer M, Rosenberg L. Sugar-Sweetened Beverages and Incidence of Type 2 Diabetes Mellitus in African American Women. Archives of internal medicine. 2008;168(14):1487-1492.

- Schulze MB, Manson JE, Ludwig DS, et al. Sugar-sweetened beverages, weight gain, and incidence of type 2 diabetes in young and middle-aged women. JAMA-J Am Med Assoc. 2004;292(8):927-934.

- de Ruyter JC, Olthof MR, Seidell JC, Katan MB. A trial of sugar-free or sugar-sweetened beverages and body weight in children. N Engl J Med. 2012;367(15):1397-1406.

- Ward ZJ, Long MW, Resch SC, Giles CM, Cradock AL, Gortmaker SL. Simulation of Growth Trajectories of Childhood Obesity into Adulthood. N Engl J Med. 2017;377(22):2145-2153.

- Long MW, Ward Z, Resch SC, et al. State-level estimates of childhood obesity prevalence in the United States corrected for report bias. Int J Obes. 2016;40(10):1523-1528.

- Imamura F, O’Connor L, Ye Z, Mursu J, Hayashino Y, Bhupathiraju SN, Forouhi NG. Consumption of sugar sweetened beverages, artificially sweetened beverages, and fruit juice and incidence of type 2 diabetes. Br J Sports Med. 2016 Apr;50(8):496-504

- Bernabe E, Vehkalahti MM, Sheiham A, Lundqvist A, Suominen AL. The Shape of the Dose-Response Relationship between Sugars and Caries in Adults. J Dent Res. 2016;95(2):167-172.

- Sheiham A, James WPT. A new understanding of the relationship between sugars, dental caries and fluoride use: implications for limits on sugars consumption. Public Health Nutr. 2014;17(10):2176-2184.

- Health First Colorado Fee Schedule. 2018; http://www.dentaquest.com/getattachment/State-Plans/Regions/Colorado/Provider-Page/Health-First-Colorado-Fee-Schedule-Effective-7-1-17.pdf/?lang=en-US.

- Ward Z, et al. NHANES III Dental Examination: An Incisive Report. unpublished report; 2018.

- Farrelly MC, Bray JW. Response to increases in cigarette prices by race/ethnicity, income, and age groups – United States, 1976-1993 (Reprinted from MMWR, vol 47, pg 605-609, 1998). JAMA-J Am Med Assoc. 1998;280(23):1979-1980.

- UCONN Rudd Center. Revenue Calculator for Sugar-Sweetened Beverage Taxes. 2014; http://www.uconnruddcenter.org/revenue-calculator-for-sugary-drink-taxes. Accessed March, 2016.

- Lynn J. City Council votes to allocate ‘soda tax’ revenue to school district, city organizations. The Daily Californian. Jan. 20, 2016, 2016.

- Friedman R. Public Opinion Data, 2013. New Haven, CT: Yale Rudd Center for Food Policy & Obesity; 2013.

- Federal Trade Commission. A review of food marketing to children and adolescents: follow-up report. Washington, DC Dec 2012 2012.

- Frieden TR, Mostashari F, Kerker BD, Miller N, Hajat A, Frankel M. Adult tobacco use levels after intensive tobacco control measures: New York City, 2002-2003. American Journal of Public Health. 2005;95(6):1016-1023.